Unknown Facts About Best Payroll Software - 2022 Reviews & Comparison

Some Ideas on Best 16 Payroll Software Q1 2022 - Shortlister You Need To Know

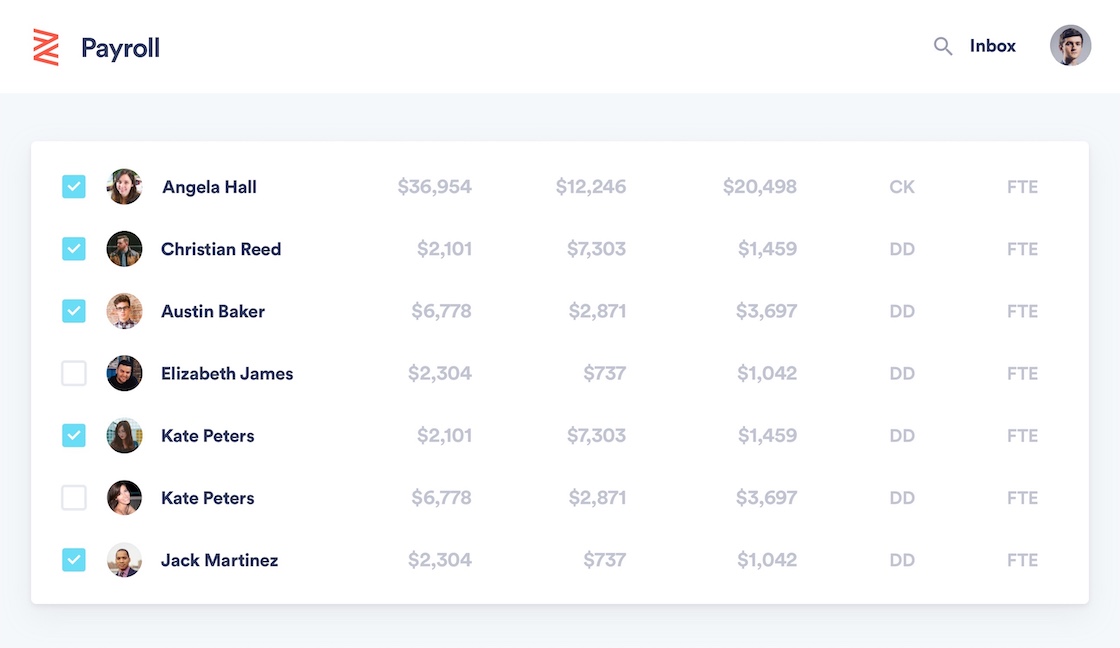

Tax companies can assess stiff fines if payroll filings and taxes aren't gotten by the arranged dates. Advantages companies can cut off services, such as medical insurance if you fall back on payments. Streamlining the Complex, Cloud-based payroll solutions can assist you arrange and automate this onerous task. Some of them offer detailed wizards that assist you through the time-intensive procedure of developing records for workers and supplying the information required for withholding.

They also do all the required calculations, and many of them send your payroll taxes and filings to the appropriate agencies. These sites stroll you through each payroll run and tell you how much each will cost you. They offer report templates, plus deal online websites and mobile apps that let staff members access pay stubs (and more, in some cases).

And they're not overly pricey: They mainly run in between $10 and $45 monthly for the base cost and charge a couple of extra dollars monthly for each employee. The benefits are obvious. You save time and lessen disappointment. You do not need to stay up to date with payroll tax tables nor handle the myriad compliance problems associated with staff member settlement.

Benefits of In-house Payroll Software for Small Business

You're much less most likely to make errors using among these services. Setting Up Your Payroll, Though each payroll site we took a look at supplies a special user experience, they all share similar structures. They begin with the setup procedure, which is without a doubt the most lengthy and detail-oriented element of paying your staff.

Fast, Easy, Accurate Payroll - BambooHR Software for Beginners

Others offer partial setup wizards and leave the rest to you. These setup wizards request information about your business, such as its address and Employee Recognition Number (EIN). Answers Shown Here choose your payroll schedule (typically weekly or biweekly) and name your payroll administrator and signatory. If your company provides advantages such as health insurance coverage and retirement strategies, you can develop records for them that lay out the expense to workers and any business contributions.

C# - Mini Payroll Application - #01- Make Own Payroll Software - YouTube

Funds will then be deducted during the payroll process. You must also create detailed records for each employee, with information such as contact details, date of birth, Social Security Number, income or per hour pay rate, and number of allowances from the W-4 type. Since most of these websites submit your payroll taxes and support direct deposit for compensation, you might require to provide bank account details.